Ethereum – a beginner’s guide

Ethereum, whose tokens go by the nickname of ‘Ether’ or the call sign ‘ETH’, has the crypto press all abuzz with its recent meteoric rise in price point. It has always been the solid number two cryptocurrency behind the industry leader, Bitcoin (BTC), but in the past two months, ETH has increased its share of the entire crypto market from 11.3% to 18.7%, while BTC’s share has fallen from 60.0% down to 41.8%. What is so special about the Ethereum project to cause such a dramatic stir within the investment community?

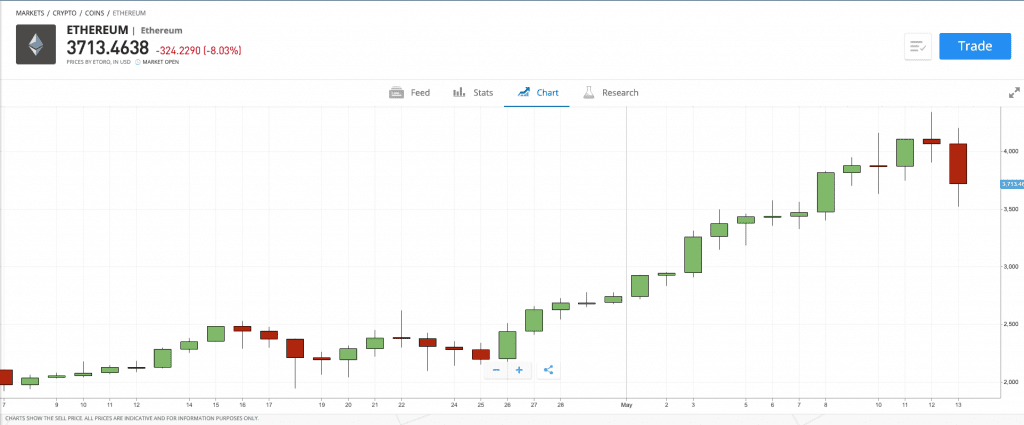

The Ethereum price history chart depicted below is quite similar to other major cryptos, an almost carbon copy of Bitcoin’s historical price rise. Analysts attribute this momentum to the fact that Ethereum is currently empowering the fastest-growing segment of the crypto economy, namely decentralised smart contracts that can vary from decentralised finance (DeFi) to non-fungible tokens (NFT). Bitcoin is nowhere to be found in this space, a fact well known to institutional investment houses, which are opening their doors to cryptos for themselves and their clients.

Ethereum’s young founder, Vitalik Buterin, a mathematical genius who dropped out of college to pursue his blockchain dreams, had been studying Bitcoin and saw the potential of greater utility of its distributed ledger technology with what are now called ‘smart contracts’. These bits of software code can perform complex computations on stored data between disparate parties without the need for an intermediary. Currently, there are over 3,000 of these decentralised apps (dApps) operating on the Ether platform. As the first mover in this industry segment, Ethereum has amassed a significant lead over its competitors and a market cap of $469bn.

Ethereum, however, is not without problem areas. Its blockchain platform suffers from several of the same headaches as Bitcoin. Speed is one problem, exacerbated by its use of a Proof-of-Work validation protocol. Delays and bottlenecks are also present, and its proprietary programming language tends to be complex and difficult to encode. Upgrades are scheduled to address these issues, shifting to a more acceptable Proof-of-Stake model and a more user-friendly language called Serenity.

Investors are confident that Ethereum has found the magic formula for longevity in the crypto space and a way to embed itself within the global economy. Businesses and developers are drawn to its platform to solve real-world problems. It does have competitors, such as EOS, Tron, Cadano, and Tezos, but it has a commanding lead and a stream of upgrades to improve perceived shortcomings in its basic infrastructure. All cryptos, however, are risky, and even though investors are stampeding to the doors of Ethereum today, things could quickly change.

Who founded Ethereum and when?

Vitalik Buterin, the founder of Ethereum, grew up in Canada, and while a student in 2011, his father introduced him to blockchain technology. Vitalik, a math prodigy at the time, soon envisioned a much broader adaptation of the technology to solve global business problems. Recognised for his astute technical writing on crypto blogs, young Vitalik left college, became the chief tech writer for Bitcoin Magazine, and in 2013 began programming with Dr Gavin Wood and several other individuals, who are often also listed as founders. In early 2014, they launched the Ethereum platform and forever changed the world of distributed ledger technology.

While Bitcoin focused on being money, it is said that Ethereum focused on everything else. Both cryptocurrencies have also provided a hedge against devaluing fiat currencies, especially during the COVID-19 pandemic when central banks expanded local money supplies to add stimulus to their respective local economies. Ethereum also has a broad community of core developers, independent developers, researchers, miners, clients and organisations, all eager to expand the usefulness and utility of the Ethereum platform. At 27, Vitalik is now a very wealthy billionaire.

How does Ethereum work?

Ethereum works via its blockchain network, which is a decentralised ledger system where all transactions are public, immutable and transparent. The system utilises a Proof-of-Work algorithm for the purposes of verifying and recording changes on the platform, and a community of miners validates new blocks for rewards of Ether. There is no total limit for ETH, as with BTC, but there is an annual limit of 18 million new tokens.

The unique feature of Ether’s value proposition is that it can be used to run various decentralised applications on its platform. Unlike an Amazon, for example, which manages a centralised service, smart contracts are said to give control of data back to users and eliminate the need for any intermediary to supervise the process. Applications have been created to service contract management, real estate transfers, medical records, the digitisation of assets, gaming, and initial coin offerings. At the last count, more than 200,000 developers are presently working on 1,400 projects that are destined for the Ethereum smart contract platform.

Is Ethereum safe and ethical?

What are the risks with Ethereum? All cryptos are high risk, but their long-term viability is tied to how broadly the global economy adopts blockchain solutions for real-world situations. Ethereum is at the heart of this effort, but anything can happen in Crypto-land going forward. Critics still claim that an asset bubble has formed, which will surely burst in the near term.

There is also performance risk. Ether 2.0 upgrades must deliver more scalability, lower fees and fewer logjams. A shift to a Proof-of-Stake algorithm will not be an easy transition, but it is designed to address ethical concerns with Proof-of-Work mining operations.

Reputation risk raised its ugly head in 2016. Smart contracts may contain bugs, or developers could be scamming the public. One entity, called ‘The DAO’, was hacked to the tune of $50m in August 2016. The controversy led to a hard fork. ETH and its support community forked at the point of the hack. Ethereum Classic (ETC) was left to pick up the pieces. Observers fear that another compromise is a possibility.

Where can you buy Ethereum?

You can purchase ETH as easily as you can buy BTC these days. Both cryptos are listed front and centre on the nearly 400 crypto exchanges across the globe. It is also offered at numerous ATMs where Bitcoin is available, and a multitude of online brokers have also entered the market to bring more convenience. Depending on what method you choose, you will need to set up an account and fund that account, or have an Ether-compatible hardware wallet and mobile app to receive your ETH for safekeeping directly from an ATM.

What can Ethereum be used for?

Ether is no different from BTC. Both can be used at the point of sale, primarily online, to purchase goods and services where the merchant has signed up with a processing organisation. Ether can also be used to buy other cryptos on crypto-to-crypto or peer-to-peer exchanges. The major difference is that ETH can be used to power applications on the Ethereum platform, sometimes referred to as ‘gas’. A large number of other crypto projects have also conformed their tokens to the ERC-20 standard so that their initial coin offering can raise Ether on Ethereum’s blockchain for subsequent conversion to the newly created token program down the road.

What does the future hold for Ethereum?

Is now the time to invest in ETH? The steepness of its recent rise in price would suggest that a major correction is due in the near term, perhaps a 25% round of profit-taking – or due to a simple loss in buyer momentum. As for the long term, there are favourable forecasts that claim that $10,000 is a realistic target for ETH by 2025. Support for Ethereum is strong in the investment world, and developers have demonstrated that they prefer to go with the industry leader in smart contracts, even though competitors keep the pot stirring.

Nevertheless, financial news on any given day can send prices into a tailspin or cause rapid appreciation. Cryptos, including Ether, are said to be the most volatile asset class in history. The risk is high and anything can happen. If cryptocurrencies are to prevail five years out, they must become ensconced in the infrastructure of international business. At this point in time, the Ethereum project seems to be well aware of this, and a successful launch of ETH 2.0 will only improve its positioning going forward. Is the risk worth the reward? You decide.

Where to learn more about Ethereum?

There are numerous sources on the internet for learning more about Ethereum. You may want to start at the Ethereum website at ethereum.org. Data aggregators such as Coingecko.com and Coinmarketcap.com also have access to a wealth of information, and general search engines can deliver a multitude of relevant news articles for your review. The Crypto-verse has a way of changing directions rapidly. Prices can swing radically from one day to the next, and it is best to stay informed, unless you plan to buy and hold for a long period of time.