Bitcoin – A Beginner’s Guide

What is Bitcoin?

The Bitcoin phenomenon has survived for more than a decade, and it has taken the world by storm. Despite valiant attempts by government officials, politicians, economists, and general critics to shut it down, it has prospered. Not only has it thrived, amassing a market capitalisation of $1.1tn, but it has also spawned the birth of nearly 10,000 competing projects, which have amassed another $1.4tn of investor capital. These significant investments do not include the billions behind 377 global exchange and ancillary support service companies that comprise the entire cryptocurrency industry.

What is Bitcoin? It is a virtual currency used to purchase goods and services, while its transactions are maintained on a decentralised ledger system known as blockchain technology. The best way to understand this ledger system is to imagine a series of blocks that cannot be changed are transparent and protected by a decentralised node system with cryptographic security underpinnings. There is no central bank managing Bitcoin, no government agency intervening to manage its supply in circulation or dilute its value. No bank uses its deposits to loan funds to disparate customers.

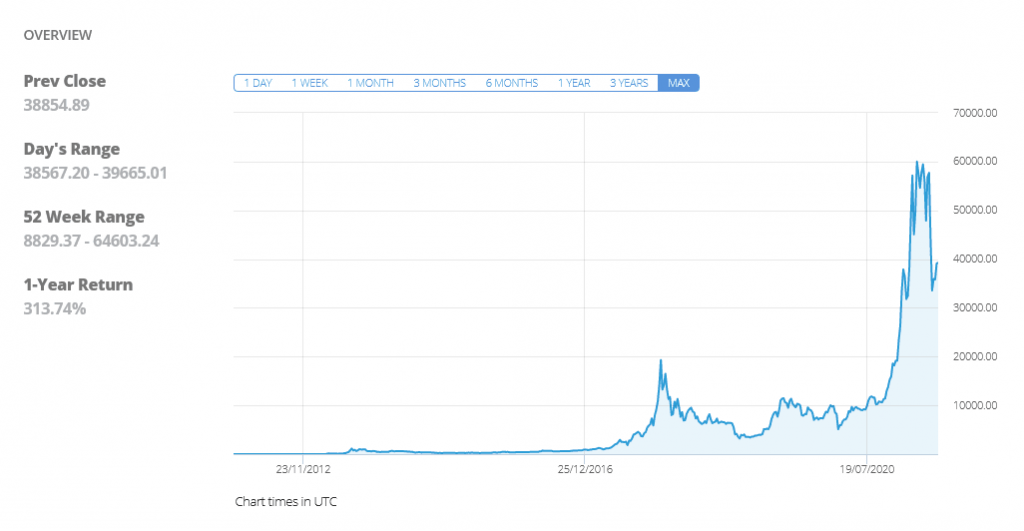

Bitcoin has appealed to investors for being a formidable store of value. Its supporters often refer it to as “Digital Gold” or “Gold 2.0”. This property alone had fuelled speculation worldwide, especially during the Covid pandemic, when major central banks expanded their respective money supplies to stimulate local economies. As fiat currencies degraded in value, Bitcoin or “BTC”, its call sign, took off like a rocket, as depicted below in the price history chart. Scarcity also plays a role – BTC issuance is limited to 21 million tokens. There are roughly 18.7 million BTC in circulation, with new blocks being generated daily by a process called “mining”.

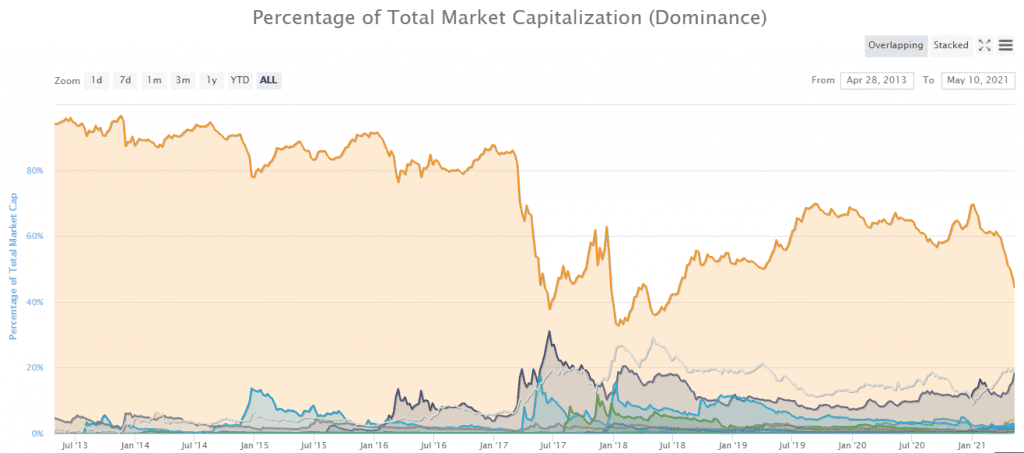

The price for one Bitcoin has been as high as $60,000, a far cry from its humble beginnings when it was worth $1. Its recent rise in value has been steep, almost asymptotic, as shown on the chart. Can this value be maintained? Can it go up in the future? There has been a recent round of profit-taking, and many investors have chosen to reinvest in alternate coin (alt-coin) programs. As measured by its market share, Bitcoin’s dominance in the crypto market has varied between 35% and 65% in the past four years. As for the future, anything can happen with cryptos. Bitcoin is risky, even though it is the market leader.

How does Bitcoin work?

If a merchant is willing to accept it, Bitcoins are like any other fiat currency when paying for goods and services. Unlike fiat currencies, however, Bitcoins are not issued at the inflation rate of the economy. The process of “mining” creates new blocks in the blockchain of newly validated transactions. Miners are nodes on the Bitcoin network with massive computing power to solve the mathematical puzzles involved with what is termed a Proof-of-Work protocol. Miners produce a new block in roughly ten minutes.

Today’s Bitcoin network is comprised of over 12,000 nodes, and the computing power of these nodes determines how and when the software is upgraded. If there is not enough agreement on proposed changes, then a “hard fork” occurs, and a new currency and platform are created. Such hard forks have created LiteCoin, Bitcoin Cash, and Ripple, to name a few. Reasons for new directions have typically been due to shortcomings in the Bitcoin design related to speed, scalability, and delays due to backlogs in processing new blocks.

Is Bitcoin safe and ethical?

The balances in Bitcoin addresses may be visible to the public, but the owner’s name is not. Anonymity has been a mainstay in the crypto-verse, but regulators and government officials have been attacking this issue for years. Forensic analytics can follow flows, detect patterns, and discern more than anonymity implies, but will these tools be enough? As long as the criminal element of society uses BTC and other cryptos to hide money flows, criminal enforcement agencies will force new rules to combat this hidden nature of cryptocurrencies.

Aside from this ethical dilemma, the word “safe” can take on different meanings with Bitcoin. There is always the risk that governments might come down hard on cryptos. A recent report from Bank of America stated that: “Encrypted private wallets with digital assets that can be transferred across borders would seem to undermine the monetary sovereignty of every nation-state.” The risk of a government shutdown is real. As for the safety of the Bitcoin network, its security is deemed unbreakable due primarily to the great dispersion of its 12,000 node network.

Where can you buy Bitcoin?

Since Bitcoin is the undisputed King of Cryptos, BTC is listed on practically every exchange, except for those few that specialise in peer-to-peer swaps of all manner of tokens. Brokers have also joined the fray, and Canada recently approved a Bitcoin Exchange Traded Fund on its national exchange. There are also nearly 17,000 ATMs at last count that can load BTC onto a mobile device wallet equipped with a QR code reader. However, for beginners, the most convenient and highly recommended online broker that can have you owning BTC in a few easy steps is eToro.com.

What Bitcoin can be used for?

Bitcoin can be used to buy goods and services, primarily online, just as with fiat currency. The merchant has to be signed up to accept BTC. The latest data on merchant numbers vary but are seen as somewhere north of 15,000. A big change occurred in April with PayPal. It is now accepting Bitcoin as legal tender on behalf of its merchants. It claims 28 million merchants in its network. Bitcoin’s one drawback is that a transaction authorisation can take longer than a simple plastic card transaction. BTC’s Lightning Network was a recent upgrade designed to improve service at the point of sale.

What does the future hold for Bitcoin?

Bitcoin is still the King of Crypto-land and shows no signs of relinquishing its crown any time soon. Yes, BTC has recently lessened its dominant hold on the industry, but the occurrence of what is known as the alt-coin season is typically temporary. The crypto market has shown a tendency to swing back and forth, but it is also true that so goes Bitcoin, so goes the entire industry. For BTC and other cryptos to succeed in the future, they need to solve real-world problems and provide value for their investors. As long as the global economy absorbs blockchain solutions into its infrastructure, the more successful Bitcoin and other cryptos will be.

Bitcoin, however, does have several trends working on its behalf. Scarcity is one since the supply of Bitcoins is limited, and fewer coins are being mined each year. Acceptance is also broadening again, as noted by the actions of PayPal. As long as central banks continue to debase their national currencies, the more Bitcoin will assume the mantel of Digital Gold. Analysts have speculated that equivalence with gold will occur when BTC hits $450,000.

It is also important not to underestimate the demand resulting from everyday consumers wanting to buy Bitcoin. In the scheme of things, Bitcoin is still an oddity for consumers. Dealing with an unknown exchange is not a familiar or safe thing for most consumers to contemplate. Investment houses have been mainly investing on their own behalf in cryptocurrencies. They are just now beginning to open the doors for their clients to invest. The future is indeed bright, but the only thing certain about cryptos is their uncertainty risk. Anything could happen in the future.

Where to learn more about Bitcoin?

There are several independent sources for unbiased information about Bitcoin on the Internet. Data aggregators like CoinGecko.com and Coinmarketcap.com are two examples. Bitcoin.com is another place to become more familiar with this cryptocurrency giant, and the financial press provides ample coverage of nearly anything to do with cryptos and Bitcoin.