Investors guide to buying Ethereum in the UK

For cryptocurrency enthusiasts, Bitcoin is the undisputed king of the realm, but do you know which of its many brethren is second in line for the throne? That would be Ethereum, better known as Ether or by its call sign ‘ETH’.

Originally conceived to complement Bitcoin, Ether certainly commands respect and consideration as an admirable investment opportunity. For a comparison of these two rivals, here is direct evidence from the past year that Ethereum would have been the better bet:

| Value March 2021 | Value March 2020 | Multiple | |

| Ethereum (ETH) | $1,686.92 | $125.01 | 13.5 |

| Bitcoin (BTC) | $54,100.00 | $5,902.05 | 9.1 |

Clearly, Ether would have been the better choice, having delivered an additional four multiples for whatever amount had been invested a year ago. The average investor, however, is unaware of this simple comparison. The intention of this guide is to pique your interest in this cryptocurrency, provide information as to why it is worthy of your attention, and demonstrate how easy it is to invest in this crypto powerhouse.

Where to buy Ethereum?

Why buy Ethereum?

Bitcoin may be the reigning champion in the crypto world, but there are several industry followers and analysts that believe that Ethereum has the better long-term chance of success, and with it, system supremacy. Both popular cryptocurrencies can be used for purchases, are an acceptable exchange of value, or can even protect against the devaluation of fiat currencies by being an accepted storehouse of value.

Ethereum has another advantage that is proving to be a game-changer. It has an easily programmable blockchain platform, which software developers have gravitated to and launched many new applications, called smart contracts. This unique Ethereum blockchain technology enables an assortment of transactions to proceed without the need for an intermediary. Imagine borrowing money or purchasing property without the need of a bank or transfer agent to act as the middleman for the undertaking.

In the market, the price for an Ether token hasn’t always grown faster than that of a single bitcoin. Markets always go through different phases where one crypto may be preferred by investors over another. But for the past year, Ethereum surpassed the industry leader by quite a margin. The reason given most often in the financial press has been the attractiveness of its blockchain platform among developers, which has grown with time.

Ether’s programming language goes by the name of ‘Solidify’, which has facilitated the global-scale phenomenon of decentralised financial applications (DeFi). It relies upon the primary strength of blockchain technology, which uses a team of computers to verify elements of a transaction instead of a centralised authority. The security of the transaction is thereby enhanced, ensuring that all parties to the deal are satisfied.

Is Ethereum the only supported cryptocurrency with this market advantage? The simple answer is ‘no’. Where there is success, there will always be competitors trying to usurp the market leader. Ethereum definitely has a sizable market lead, but there are other rivals like Cardano whose intent is to supplant the Ethereum platform’s popularity with its own network. The market cap of Ethereum is nearly five times that of Cardano.

The Ethereum approach was the brainstorm of a young genius, Vitalik Buterin, who wanted to leverage the blockchain and its decentralised ledger technology to bring a multitude of businesses to the platform. Ethereum Request for Comment, proposal 20 or ‘ERC-20’, established industry-wide standards for other token systems to use the Ethereum platform for their apps and for the exchange of value between coins.

Fast forward to the present day, and most crypto coins are compatible with ERC-20 standards and use the Ethereum platform as a gateway for their offerings. The demand for ETH open-sourced code applications has grown and will continue to grow in future. The scope of these applications is broad, including simple exchanges to gaming, entertainment, medical, the crowdfunding of new projects and a host of other ideas.

Developers are also anxiously awaiting the release of Ethereum 2.0, otherwise known as Eth2 or Serenity, which is a set of upgrades designed to increase the speed, efficiency, and scalability of the existing blockchain platform and network. Although these changes are technical in nature, the basic reconciliation process will shift from proof-of-work (PoW) to a proof-of-stake (PoS) mechanism. PoS tends to be more energy-efficient.

Ethereum (ETH) is not to be confused with its spin-off, Ethereum Classic (ETC). As a result of a platform compromise in 2016, developers debated what would be the best approach to blocking similar hacking attempts in future. There was a basic disagreement on the best path to take, and when an agreement cannot be reached in the crypto world, the solution is often a ‘hard fork’. The system split into two separate cryptocurrencies — ETH and ETC.

How do you go about purchasing Ethereum? Before jumping to the step-by-step guide that follows, it is advisable to fully prepare for your Ether adventure. Awareness is key, and you have begun your preparatory work by reading this very article. Expand your knowledge by checking the current financial press related to Ethereum, its recent price gains and losses, future prospects and when might be the best time to enter the market.

You will also want to develop a strategy that tells you when to enter the market, how much capital to put at risk, how to protect your downside, and when you might want to exit your position. If your broker has a free demo trading system, use it to practice your own unique strategy and use your favourite indicators to suggest a prudent entry point. Buying on the dips and selling at a higher price is always a winning strategy.

Once you have completed your basic preparation, your next step is to select a broker or exchange and open an account. If you choose a crypto exchange in your home country, then you may be able to deal in your own currency and utilise local payment methods. There are also decentralised exchanges that facilitate peer-to-peer trades of various digital currencies included in their respective offerings. Many exchanges today store your coins offline in a secure vault, but you may also want to consider using a ‘hardware wallet’ for added security and proof of ownership. Ledger Nano and Trezor One are excellent options in this arena.

Expect to be asked for personal information during the process. Government officials across the globe require brokers to abide by ‘Know Your Customer’ (KYC) rules. These identity checks must be in place before any withdrawal can be made. Once approved, the broker or exchange will provide instructions on how to fund your account, how to use its trading platform, and how to place an order for the investment of your choice.

Step by step guide

Setting up a trading account and trading Ethereum on a platform such as eToro is very straightforward. First, you will need to create an eToro account where you will have to provide some personal details, general trading experience, telephone verification, tax ID, or passport particulars.

- On the eToro.com page, find and click on the button marked ‘Join Now’ or ‘trade now’.

- On the following web page, you will see an electronic form where you can enter all the personal data required to open a new trading account.

- Fill in all the relevant information requested. Logging in via Facebook or Gmail are additional options.

- Upon completing your review of all the terms, indicate your agreement with eToro by checking the appropriate box.

- Submit your information by clicking the ‘sign-up’ button.

Once your trading account is set up, you should note that, under a green tab, you have access to a ‘real’ or ‘virtual’ account. The virtual account is a demo account that allows you to build a portfolio of up to $100,000. It provides invaluable experience in developing and understanding risk within a portfolio. The real account will only be activated once you have deposited funds on the platform. It is activated via the blue ‘deposit funds’ tab.

- Log in to your account

- Click on ‘deposit funds’

- Enter the amount and select the currency

- Finally, choose your preferred deposit method

There is a wide range of payment methods from credit/debit cards to PayPal, Neteller, Skrill, Rapid Transfer, iDEAL, online banking or bank transfer.

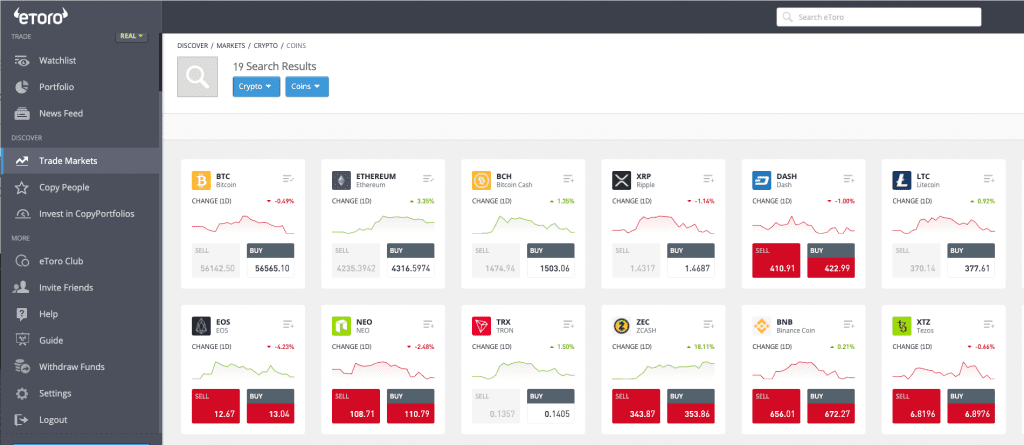

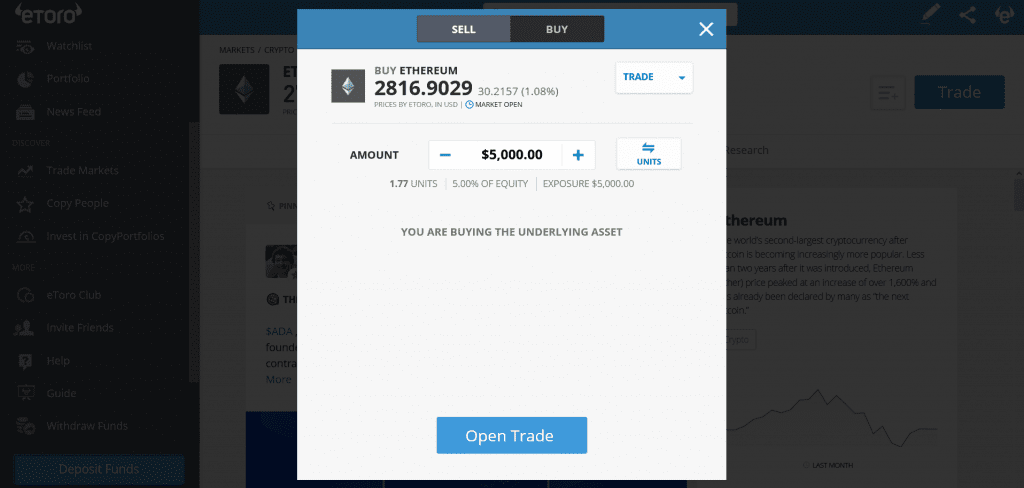

When adding Ethereum to your portfolio, go to the search button at the top of your activated account page. Type in ‘Ethereum’ to give you your options as to what is available to trade. As you can see from the screenshot below, the underlying asset has been chosen. Helpfully, eToro enables you to trade different currencies of Ethereum and in the form of cash.

It is also possible via the eToro site to buy fractions of a unit, as in this example where $4,500 is equivalent to 2.6 units.

Once you are comfortable with the position you wish to have in Ethereum, press the blue ‘open trade’ button. That will activate your position. Note that there are no additional commissions or fees charged by eToro, but there is a 2% spread for this trade.

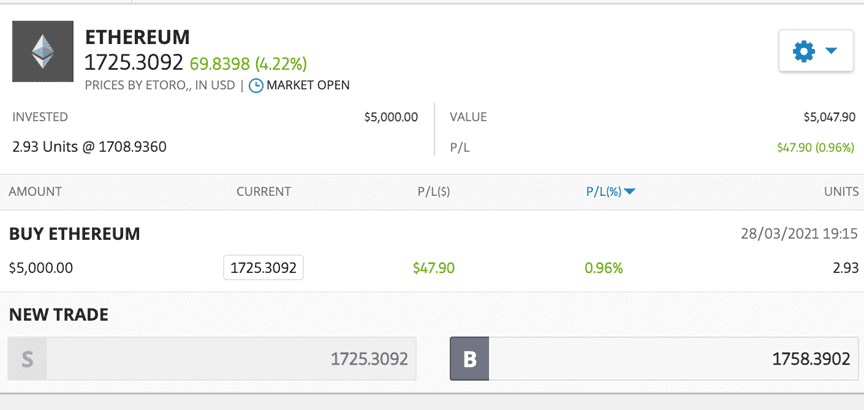

Below is an example of an Ethereum position held in a virtual portfolio. It gives you full details of the invested position, when it was traded, and the status of the profit/loss. This is a real-time link that enables you to activate a new trade if required. Under the ‘settings’ icon (top right), you can view the underlying asset chart and set price alerts.

Conclusion

Investing in the leader in a market is often a safe move, but the second in line may offer more opportunity since it is trying harder to gain share. Bitcoin may account for around 60% of the global crypto market cap of $1.7tn, but Ethereum has an 11.2% share, which has grown from 8.2% over the past year.

As for future prospects, analysts are confident that the demand for Ethereum and its platform services will continue to grow, especially with the release of Ethereum 2.0.

Investing in even the largest cryptocurrencies can be highly risky. While the acceptance of Bitcoin and other tokens increases with each passing day, market prices can fluctuate wildly when industry news releases threaten government intervention or a regulatory crackdown. Volatility may represent opportunity for veteran currency traders, but for the buy-and-hold investor, it might be best to invest cautiously and wait five years for results.