Investors guide to buying Tezos in the UK

Tezos is one more attempt in the crypto-verse to attack the dominance of Ethereum’s smart contract platform, but with a few distinguishing features designed to give it a unique advantage over its rival.

According to its development team, Tezos is Greek for “smart-contract”, and as the project’s initial whitepaper implies, it is based upon democratic principles. The paper was entitled “Tezos – a self-amending crypto-ledger”. Development upgrades must receive a majority vote from participating nodes in the network, thereby foregoing the possibility of a hard fork, and nodes act as “bakers, not “miners” when validating blocks via a liquid Proof-of-Stake protocol.

The genesis of this innovative approach, however, was steeped in controversy. One of the most successful ICOs in history raised $232m in 2017, but its founders and the Tezos Foundation were at loggerheads over how to proceed. Delays ensued, which resulted in several lawsuits being consolidated into one. The SEC was an observer on the sidelines, but the plaintiffs wanted restitution of their XTZ, also known as tez or tezzies, token investments. A settlement of $25m was made, the head of the Tezos Foundation resigned, and the project moved forward. Its Mainnet was launched in September 2018, late into Crypto Winter. However, the unfortunate beginning has resulted in a more traditional price growth curve history, as depicted below. XTZ hit its peak of $7.64 in 2021, has a market cap of $5.1bn and is #36 in the crypto ranks.

Where to buy Tezos

Why buy Tezos?

Tezos is one more decentralised blockchain ledger system that has designs on being the leading launch platform for decentralised applications or “dApps” for short. Its developers, however, have a unique value proposition: “Tezos takes a fundamentally different approach by creating governance rules for stakeholders to approve of protocol upgrades that are then automatically deployed on the network.” Tezos tokens are XTZ and are “baked”, not “mined”. Its Proof-of-Stake mechanism is also a defining attribute that increases speed and scalability, but observers are uncertain about how stress-tested its “liquid” PoS validation model is.

Tezos was a little late to the crypto game, but it has been termed a “3rd Generation Blockchain”. It is said to have a better chance at evolving than older models like the industry leader in smart contracts, Ethereum. The founders of Tezos are Kathleen and Arthur Breitman, both with distinguished careers in financial services and students of Bitcoin and its quirks. The project’s Initial Coin Offering raised some $232m throughout 2017, but the problems began soon after that.

The Tezos Foundation was formed in Zug, Switzerland, and its appointed CEO, Johann Gevers, created a power struggle over how the funds were to be used going forward. The resulting delays caused discord among a subset of investors that sued to have their investments returned. Oddly enough, the SEC sat on the sidelines while the battle raged over security registration issues. The cases were numerous, but the litigants’ efforts were combined, and a $25m settlement was agreed to in August 2020. The internal crisis was settled much earlier in 2018 when Gevers resigned.

The internal governance formula for Tezos allows stakeholders to vote on upgrades, and its Liquid PoS consensus mechanism enables block creation by specific validating network nodes called “bakers”. Rewards in the form of XTZ flow to bakers after they validate new blocks. The process is a bit more complicated due to delegating stakes to avoid the risk of dilution, but by January 2021, over 80% of a possible 768.7 million tokens have been minted.

Can the Tezos model succeed in the future? A Tezos news website touts over one million accounts, and a “12X” multiple in dApp transaction calls over the past year. Supporters claim the self-amending aspect of the Tezos platform allows for quicker upgrades and the fast adoption of proposed new decentralised applications. Will this advantage move share? You be the judge.

Step by step guide

Tezos tokens are listed on most major exchanges and online agents due to their unique value proposition and the success of the early ICO. The eToro.com website offers a convenient way to invest in XTZ in five simple steps:

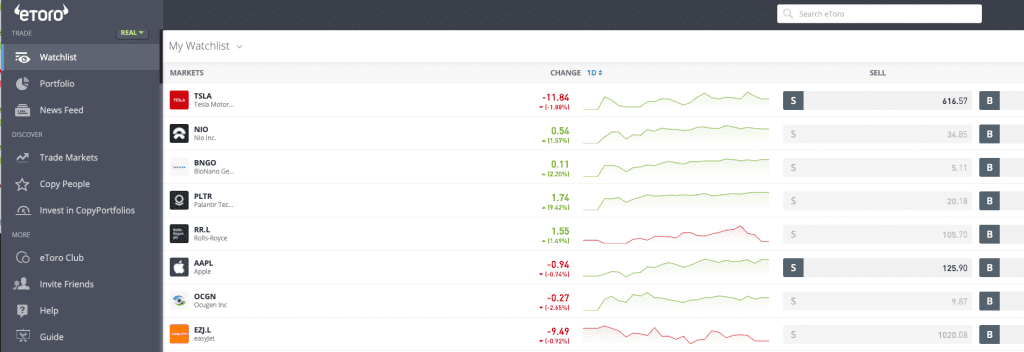

Step 1: Go to the eToro.com website. Pressing the “Join Now” button will initiate the account setup process. The broker must by law acquire personal identity information from you, as well as answers to profile questions in order to serve you better.

Step 2: In a matter of a few minutes, your application will be reviewed and approved. Your Desktop screen will become your command centre, both for Real and Virtual practice sessions. To invest, you must press the “Deposit Funds” button.

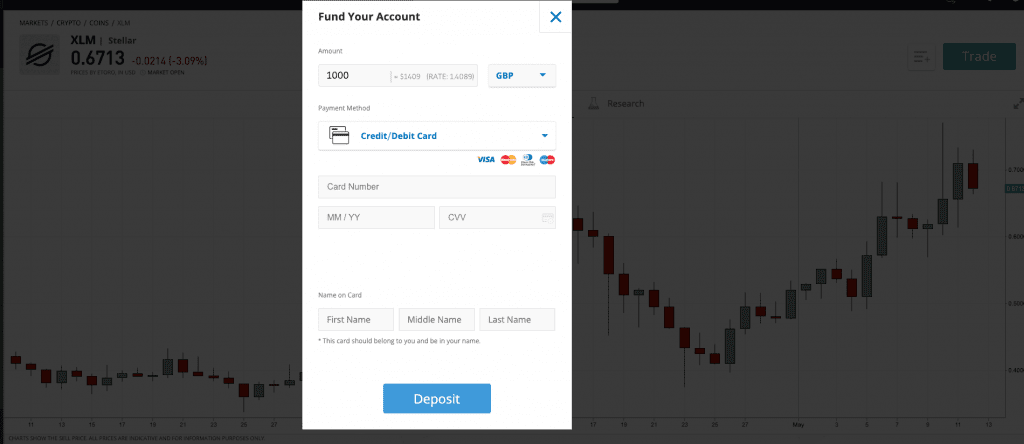

Step 3: Various deposit fund transfer methods will be presented based on your permanent residence. A credit/debit card option is depicted below. Decide on a method and an amount, and then the website will take it from there.

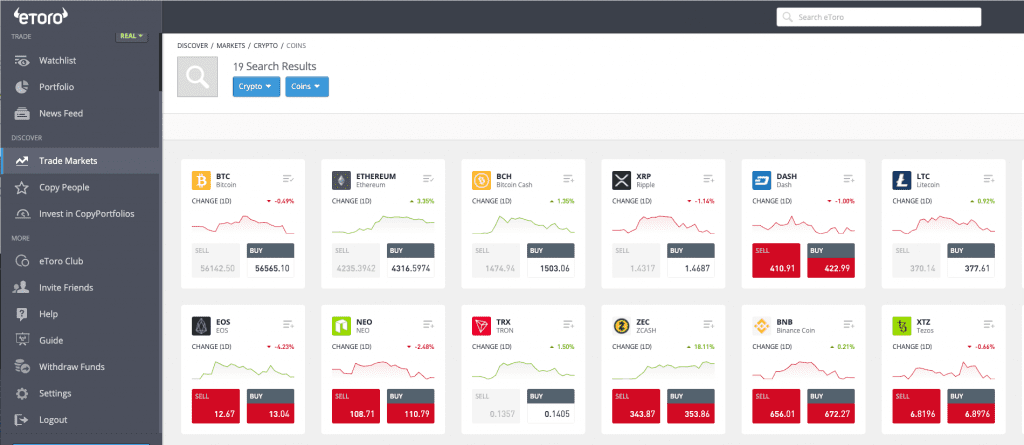

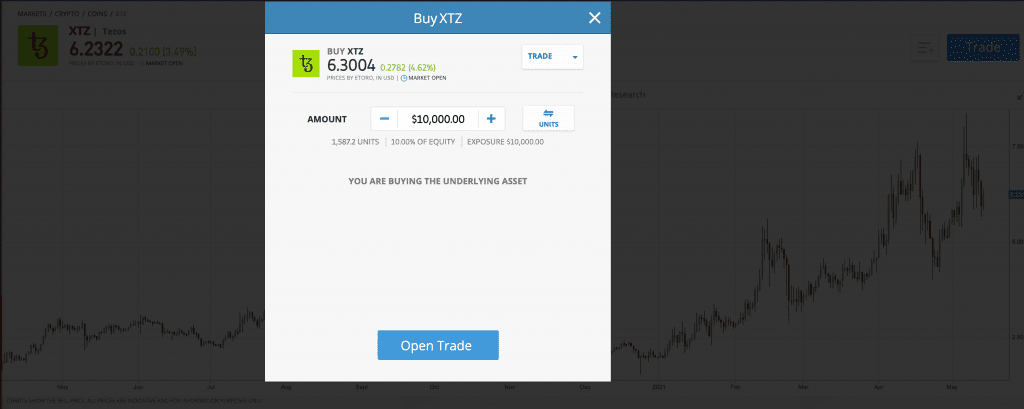

Step 4: When funds appear in your Portfolio section on your Desktop, you are ready to buy. Tap the “Trade Markets” tab, then “Crypto” in the heading, and scroll down until you find the XTZ, the symbol for Tezos tokens. Select “Buy” when you wish to invest.

Step 5: Lastly, a Buy Order will appear. Enter the amount of fiat currency from your account that you wish to deploy and press “Open Trade”. The eToro platform will execute your order, deliver the appropriate units of XTZ to your portfolio, deduct your cost, and do the record-keeping in the background on your behalf.

Concluding remarks

Tezos is one of the more interesting wannabe “Ethereum Killers” on the market in that it did not hit the ground running in 2017 when the hype surrounding cryptos drove prices sky-high. It raised a generous amount of capital from its ICO, but its price did not achieve an enormous all-time-high. That could have become a real obstacle down the road, as it has for many other alternative token programs. As a result, its growth history appears more traditional, with a solid trend line pointing to favourable prospects.

Is Tezos a worthy investment? Probably, as long as cryptocurrencies survive, thrive, and become ensconced in the global economy and as long as its rivals in the smart contract dApp arena, like Ethereum, EOS, TRON, and Cardano, do not run it into the ground. Tezos does appear to have a somewhat bright future; however, it must perform and deliver. Its recent run-up in price is indicative of a supportive investor base, and its market cap of $5.1bn is also a solid foundation. The Tezos Foundation treasury is also said to have $500m reserved for development. It is risky, but it is your decision to make if its progress to date warrants your attention.